Discover - EPAT

Executive Programme in Algorithmic Trading

ProED presents:

Now available in Thailand

EPAT - Algorithmic Trading

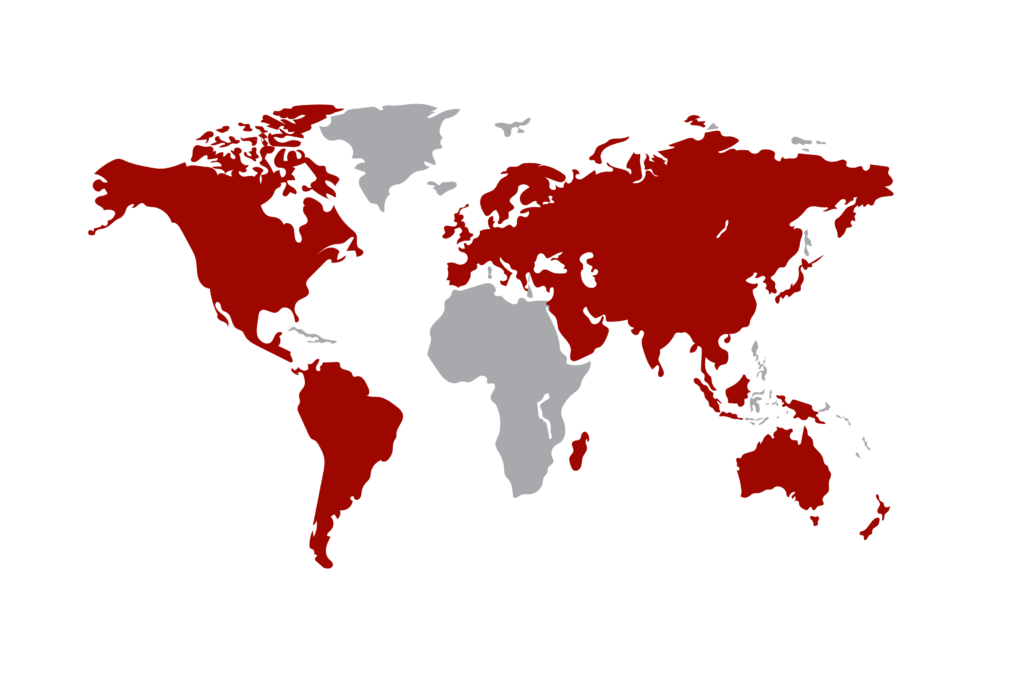

70+ Countries

ProED with QuantInsti

EPAT provides a unique chance to its participants, to work

under the mentorship of renowned practicing domain experts.

Other opportunities include practical training in designing and

implementing advanced algorithmic trading strategies using

popular and effective tools and platforms.

Why Algorithmic Trading (EPAT)

Fast Programme

Get trained within a short span of 6 months

Hands On

Theoretical knowledge and practical exposure to the concepts of the domain

Expertise in field

Learn from leading industry practitioners from across the globe

Focused Field

Domain expertise, be it trading, analysis or technology

Direct Contact

Opportunity to work on a project under the mentorship of practitioners with rich experience

Be Recognized

Get certified from one of the most prominent quantitative trading training institute

World Class Faculty

Algorithmic Trading - Curriculum

Before the starting of a batch or/and during the first month of our algorithmic trading programme, the primer topics in the fields of Statistics, Econometrics, Options, Financial markets basics, Excel computation and Python programming are covered. There are short tests on each of these topics which allow participants to test their knowledge in these fields.

2 preparatory lectures have been introduced to EPAT: Lecture 1 – Python and Lecture 2 – Statistics.

These lectures are conducted 2 weeks prior to the beginning of EPAT lectures and are extremely beneficial in establishing your base in these topics.

The first month is on introductory topics in Algorithmic Trading such as basic statistics, programming basics and understanding of order book & execution strategies so that a strong foundation is laid for the rest of the programme.

- Basics of Algorithmic Trading: Know and understand the terminology

- Excel: Basics of MS Excel, available functions and many examples to give you a good introduction to the basics

- Basics of Python: Installation, basic functions, interactive exercises, and Python Notebook

- Options: Terminology, options pricing basic, Greeks and simple option trading strategies

- Basic Statistics including Probability Distributions

- MATLAB: Tutorial to get an hands-on on MATLAB

- Introduction to Machine Learning: Basics of Machine Learning for trading and implement different machine learning algorithms to trade in financial markets

- Two preparatory sessions will be conducted to answer queries and resolve doubts on Statistics Primer and Python Primer

- Data Visualization: Statistics and probability concepts (Bayesian and Frequentist methodologies), moments of data and Central Limit Theorem

- Applications of statistics: Random Walk Model for predicting future stock prices using simulations and inferring outcomes, Capital Asset Pricing Model

- Modern Portfolio Theory – statistical approximations of risk/reward

- Data types, variables, Python in-built data structures, inbuilt functions, logical operators, and control structures

- Introduction to some key libraries NumPy, pandas, and matplotlib

- Python concepts for writing functions and implementing strategies

- Writing and backtesting trading strategies

- Two Python tutorials will be conducted to answer queries and resolve doubts on Python

- Detailed understanding of ‘Orders’, ‘Pegging’, ‘Discretion Order’, ‘Blended Strategy’

- Market Microstructure concepts, order book, market microstructure for high frequency trading strategy

- Implementing Markow model and using tick-by-tick data in your trading strategy

- Understanding of Equities Derivative market

- VWAP strategy: Implementation, effect of VWAP, maintaining log journal

- Different types of Momentum (Time series & Cross-sectional)

- Trend following strategies and Statistical Arbitrage Trading strategy modeling with Python

- Arbitrage, market making and asset allocation strategies using ETFs

- Implement various OOP concepts in python program – Aggregation, Inheritance, Composition, Encapsulation, and Polymorphism

- Back-testing methodologies & techniques and using Random Walk Hypothesis

- Quantitative analysis using Python: Compute statistical parameters, perform regression analysis, understanding VaR

- Work on sample strategies, trade the Boring Consumer Stocks in Python

- Two tutorials will be conducted after the initial two lectures to answer queries and resolve doubts about Data Analysis and Modeling in Python

- Modeling data with AI, index and predicting next day’s closing price

- Supervised learning algorithms, Decision Trees & additive modeling

- Natural Language Processing (NLP) and Sentiment Analysis

- Confusion Matrix framework for monitoring algorithm’s performance

- Logistic Regression to predict the conditional probability of the market direction

- Ridge Regression and Lasso Regression for prediction optimization

- Understand principle component analysis and back-test PCA based long/short portfolios

- Reinforcement Learning in Trading

- How to build trading Systems while not overfitting

- System Architecture of an automated trading system

- Infrastructure (hardware, physical, network, etc.) requirements

- Understanding the business environment (including regulatory environment, financials, business insights, etc.) for setting up an Algorithmic Trading desk

- Time series analysis and statistical functions including autocorrelation function, partial autocorrelation function, maximum likelihood estimation, Akaike Information Criterion

- Stationarity of time series, Autoregressive Process, Forecasting using ARIMA

- Difference between ARCH and GARCH and Understanding volatility

- Introduction to Interactive Brokers platform and Blueshift

- Code and back-test different strategies on various platforms

- Using IBridgePy API to automate your trading strategies on Interactive Brokers platform

- Interactive Brokers Python API

- Different methodologies of evaluating portfolio & strategy performance

- Risk Management: Sources of risk, risk limits, risk evaluation & mitigation, risk control systems

- Trade sizing for individual trading strategy using conventional methodologies, Kelly criterion, Leverage space theorem

- Options Pricing Models: Conceptual understanding and application to different strategies & asset classes

- Option Greeks: Characteristics & Greeks based trading strategies

- Implied volatility, smile, skew and forward volatility

- Sensitivity analysis of options portfolio with risk management tools

- Self-study project work under mentorship of a domain/expert

- Project topic qualifies for area of specialization and enhanced learning

EPAT exam is conducted at proctored center

Download the Brochure

Save your spot

Super Early Bird

31th July 2022

-

6 Month Programme

-

Verified Certification

-

Online Access

-

Weekend Classes

-

Optional Primer Module

-

7-days a week support team

-

Network with experts

-

Life Long Learning

Early

4th September 2022

-

6 Month Programme

-

Verified Certification

-

Online Access

-

Weekend Classes

-

Optional Primer Module

-

7-days a week support team

-

Network with experts

-

Life Long Learning

Standard

15th October 2022

-

6 Month Programme

-

Verified Certification

-

Online Access

-

Weekend Classes

-

Optional Primer Module

-

7-days a week support team

-

Network with experts

-

Life Long Learning

Want to know more?

Schedule a FREE counseling session and our advisors got you covered!